Square has been one of the most disruptive technology companies in the past decade, yet they recently caught the media’s attention for the wrong reason. Since the start of COVID-19, Square has begun to hold back 20 to 30 percent of some of their client’s revenues for up to 4 months. Square has addressed this practice by stating that the money is held in reserves to protect Square against consumer chargebacks or high-risk transactions. However, Square clients affected by the new policy have provided proof that they have no history of conducting risky business or high volumes of chargebacks. Merchants charging over $5000 in monthly transactions will be better served finding a payment processor for the most cost effective option. Let’s examine the difference between Payment Facilitators (such as Square) and Payment Processors.

Payment Processor vs. Payment Facilitators

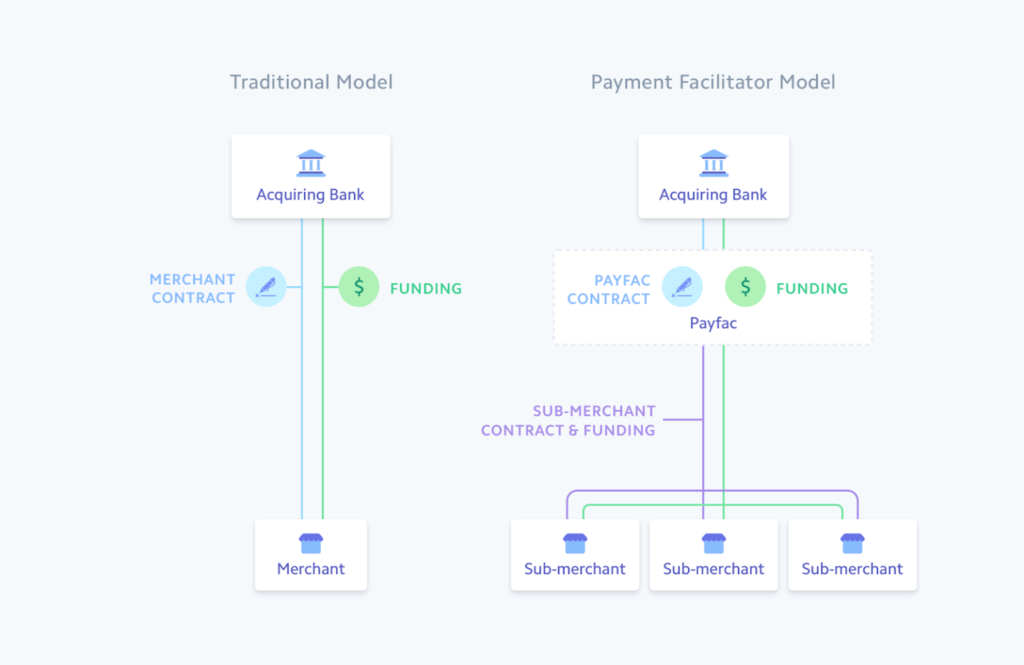

Once a credit card is swiped at a business or used by a consumer online to purchase something the transaction needs to be approved by an acquiring bank to complete the purchase and transfer the money from the customer to the merchant. In a traditional Payment Processor model, the merchant has a direct relationship with the acquiring bank. In a payment facilitator model the merchant establishes a relationship with the payment facilitator, such as Square or Stripe, and the payment facilitator maintains relationships with the acquiring banks.

Payment Processors have Caught up with Payment Facilitators

It has been about 11 years since Square entered the payments industry. In this time, traditional Payment Processors, such as WorldPay and Elavon, have invested heavily in technology to eliminate the small advantage Square once held in pricing and customer usability. With topflight hardware and Point-of-Sale software the payment processors can beat the rates offered by payment facilitators, while offering merchants more control over their business. Merchants are at the mercy of their Payment Facilitator maintaining the relationship with the acquiring bank and if a merchant account is cancelled, the merchant will likely find out the day of. With Payment Processors, where the merchant has a direct relationship with the acquiring bank, there is more transparency in the relationship. This leads to merchants having time to find a new processor or advance notice that some of their revenue will be held in reserves.

Contact us today to set up a complimentary analysis of your current payment processing solution!